Category: Tax Planning

How to Reduce Your Income Tax Legally with Effective Tax Planning

Every year, millions of people search for ways to reduce income tax legally. The good news? You don’t need to be a financial expert to…

How to Create a Smart Tax Planning Strategy for Maximum Savings

In today’s fast-changing financial landscape, developing a robust tax planning strategy is more important than ever. Whether you’re an individual wage earner, a self-employed professional,…

How to Build Wealth Using Basic Economic Principles

Understanding how to build wealth economics is not just about earning more — it’s about applying time-tested principles from economics to your personal finances. When…

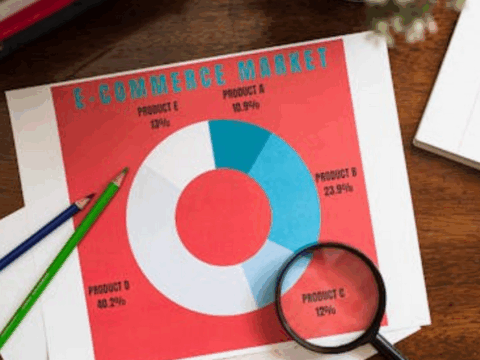

How to Predict Market Trends Using Economic Indicators

Understanding how to predict market trends is one of the most valuable skills for investors, traders, and entrepreneurs. The global economy constantly shifts, influenced by…

How to Calculate Your Income Tax Accurately Without Errors

Accurate income tax calculation is essential for every taxpayer who wants to avoid penalties, maximize savings, and stay compliant with government regulations. Whether you’re a…

How to Understand Tax Brackets and Plan Your Income Strategically

Many taxpayers dread tax season because they don’t fully understand how the system works. Yet, learning the basics of understanding tax brackets can help you…